20 Excellent Suggestions To Picking AI Stock Predictions Analysis Websites

20 Excellent Suggestions To Picking AI Stock Predictions Analysis Websites

Blog Article

Top 10 Tips For Assessing The Market Coverage Offered By Ai-Based Stock Prediction/Analysis Platforms

The coverage of markets on the trading platforms that use AI stock prediction/analysis is critical as it determines the markets and assets you have access to. Platforms with extensive market coverage allow you to diversify your options and discover global opportunities as well as adapt to different trading strategies. These are the top 10 tips for assessing the market coverage of these platforms:

1. Evaluate Supported Asset Classes

Stocks - Ensure that you are connected to major stock exchanges, such as NYSE and NASDAQ. Additionally, make sure that your platform provides small-caps and mid-caps.

ETFs: Make sure that the platform provides an array of ETFs to offer diversified exposure across different categories, themes, and regions.

Options and futures. Make sure the platform has derivatives such as futures, options and other instruments leveraged.

The commodities and forex. Find out if the platform provides forex pairs as well as base and precious metals, energy products, and agricultural commodities.

Check if the platform is compatible with the major copyright, like Bitcoin and Ethereum as well as alternative currencies.

2. Verify the coverage area

Global markets - Check that the platform has the capacity to serve every major market around the globe which includes North America (including copyright), Europe, Asia-Pacific markets, and emerging ones.

Regional focus: Make sure you know if the platform is focused on particular markets or regions which match your trading preferences.

Local exchanges - Check for local or regional exchanges in relation to your location and strategy.

3. Think about comparing real-time data to delayed data Delayed Data

Real-time data: Ensure that the platform has real-time market data to make quick decisions, particularly for active trading.

Delayed data - Check whether delayed data is free or available at a cheaper cost. This could be enough for investors looking to invest for the long-term.

Data latency: Check if the platform minimizes latency for real-time data feeds especially in high-frequency trading.

4. Evaluation of Data from the Past

In depth of Historical Data Check that the platform provides extensive historical data for backtesting as well as analysis and testing (e.g. 10or more years).

Granularity: Check whether the historical data contains intraday granularity, as well with weekly, daily and monthly.

Corporate actions: Check to determine if the data has been reported prior to. Dividends as well as stock splits and all other corporate actions must be included.

5. Find out the market's depths and place an order for books

Platforms must provide Level 2 data (order-book depth) to improve price discovery and execution.

Spreads for bids: See if the platform displays real-time bid-ask spreads to ensure precise pricing.

Volume data: Find out if your platform offers detailed volume data to analyze market liquidity and market activity.

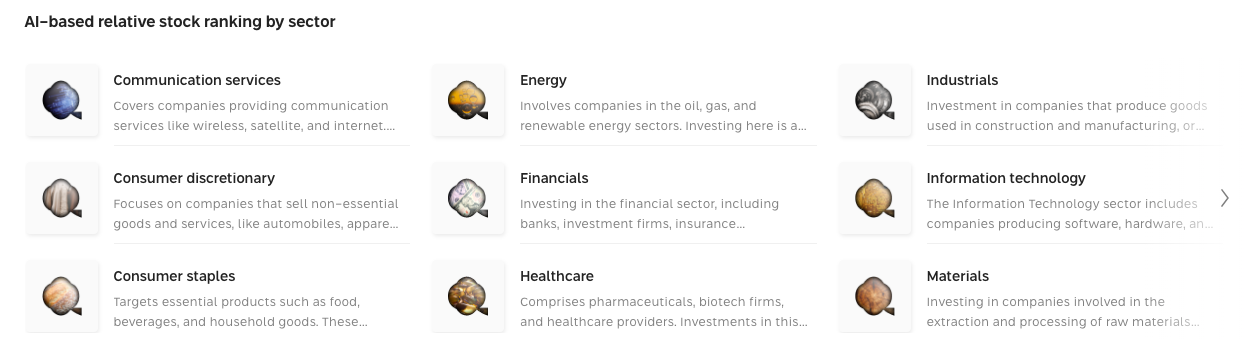

6. Review the coverage of Indices and Sectors

Major indices : Ensure you are using a platform that incorporates the major indices. (e.g. S&P 500, NASDAQ 100, FTSE 100 ) This is essential for benchmarking as well as index-based strategy.

Information from specific industries for targeted analysis, you should verify whether the platform contains information for specific sectors (e.g. technology, health care technology, etc.).

Custom indexes: Check if the platform allows the creation of or tracking of custom indices based on your preferences.

7. Test the combination of Sentiment and News Data

News feeds: Ensure the platform incorporates real-time news feeds from reputable sources (e.g., Bloomberg, Reuters) for market-moving events.

Sentiment analysis: Check whether the platform offers tools for analyzing sentiment based on news media, social media or other data sources.

Event-driven strategies (e.g. earnings announcements or economic reports): Check if your platform supports trading strategies that rely on events.

8. Check for Multi Market Trading Capabilities

Cross-market trading: Make sure the platform supports trading across multiple asset classes, markets and exchanges from one interface.

Conversion to currencies: Make sure the platform supports multi-currency as well as automated conversion of currencies for international trading.

Support for time zones: Check whether your platform permits you to trade in different time zones.

9. Examine Alternative Data Sources

Check for alternative data sources.

ESG data: Determine whether the platform offers environmental Governance, Social and Governance (ESG) information to aid in socially responsible investment.

Macroeconomic data: Make sure the platform provides macroeconomic indicators (e.g., inflation, GDP, or interest rates) for analysis of fundamentals.

Review reviews and feedback from customers as well as the reputation of the market

User feedback is a fantastic way to evaluate the market the platform's coverage.

The reputation of the market Check whether there are any awards or experts who recognize the platform's broad coverage of markets.

Case studies: Search for case studies, testimonials, and other data that demonstrates the effectiveness of the platform on particular assets or markets.

Bonus Tips

Trial period - You can use the free demo or trial to check out the data coverage and market coverage.

API access: Determine if your platform's API is able to access market data programmatically to conduct custom analysis.

Support for customers. Check that the platform will provide assistance for data or market related questions.

These tips will help you assess the market coverage of AI stock-predicting/analyzing trading platforms. You will be able select one that offers access to data and markets for profitable trading. Market coverage is crucial to diversify portfolios, discover new opportunities and to adapt to changing market conditions. See the recommended ai trading hints for site advice including trading with ai, ai investing app, ai investing app, ai stock market, best ai trading software, chart ai trading assistant, investing ai, best ai stock trading bot free, ai stock, ai trade and more.

Top 10 Ways To Evaluate The Transparency Of Ai Stock Trading Platforms

Transparency is an important factor to take into consideration when evaluating AI trading and stock prediction platforms. Transparency is crucial since it lets users trust the platform, understand the choices made, and check the accuracy. Here are 10 suggestions to determine the authenticity of these platforms:

1. A Clear Explanation on AI Models

Tip Check to see whether the platform provides a clear description of the AI algorithms, models, and platforms used.

What's the reason? Understanding the fundamental technology helps users assess its reliability and limitations.

2. Disclosure of Data Sources

Tip : Determine whether the platform makes public what sources of data are being used (e.g. historical stocks, news or social media).

What: By knowing the data sources, you can ensure that the platform is using trustworthy and accurate data.

3. Performance Metrics, Backtesting, and Results

Tip: Check for transparency in the reporting of performance metrics (e.g. rate of accuracy, ROI) and backtesting results.

The reason: It allows users to verify the platform's effectiveness and historical performance.

4. Real-Time Updates and Notifications

Tip. Determine if your platform can provide real-time information and alerts regarding trades or changes in the system, for example trading predictions.

Why is this? Real-time transparency enables users to be updated on all critical actions.

5. Transparency in Communication regarding Limitations

Tips Make sure the platform outlines its risks and limitations in relation to forecasts and trading strategies.

Why: Acknowledging your limitations will build trust with customers and allow them to make decisions based on facts.

6. User Access to Raw Data

Tip: Evaluate whether users can access raw data or intermediate results that are used by the AI models.

Why: The raw data are available to the user for their personal analysis.

7. Transparency of Fees and Costs

TIP: Ensure that all subscription fees, charges and possible hidden costs are clearly disclosed on the website.

Transparent pricing builds trust and helps avoid surprises.

8. Regularly scheduled reports and audits

TIP: Find out if the platform regularly releases reports or undergoes third-party audits to validate its operations and performance.

Why: Independent verification adds credibility and guarantees accountability.

9. Explanability of Predictions

Tip: Check if the platform provides information on how recommendations or predictions (e.g. feature importance or decision tree) are generated.

Why Explainability is important: It helps you to understand the impact of AI on your decisions.

10. User Feedback and Customer Support Channels

Tips. Determine whether there are any channels that can be used to provide feedback from users, support, and transparency in responding to concerns of users.

Reason: Responsive Communication shows an commitment to transparency, and user satisfaction.

Bonus Tip Regulatory Compliance

Check that the platform meets all financial rules. It must also reveal the status of its compliance. This adds an additional layer of security.

When you carefully evaluate these elements, it is possible to determine if an AI-based stock forecasting and trading system functions in a transparent way. This allows you to make informed decisions and build confidence in the capabilities of AI. Check out the recommended ai stock trader examples for website advice including best stock prediction website, stock predictor, stock predictor, ai in stock market, ai in stock market, ai options, best ai trading platform, ai stock trader, ai for trading stocks, stock predictor and more.